Students loans just got pricier

April 18, 2017

I remember waking up a couple months back to find that Betsy DeVos had been voted in as secretary of “educatuon“- thanks to the official White House Snapchat for that gem.

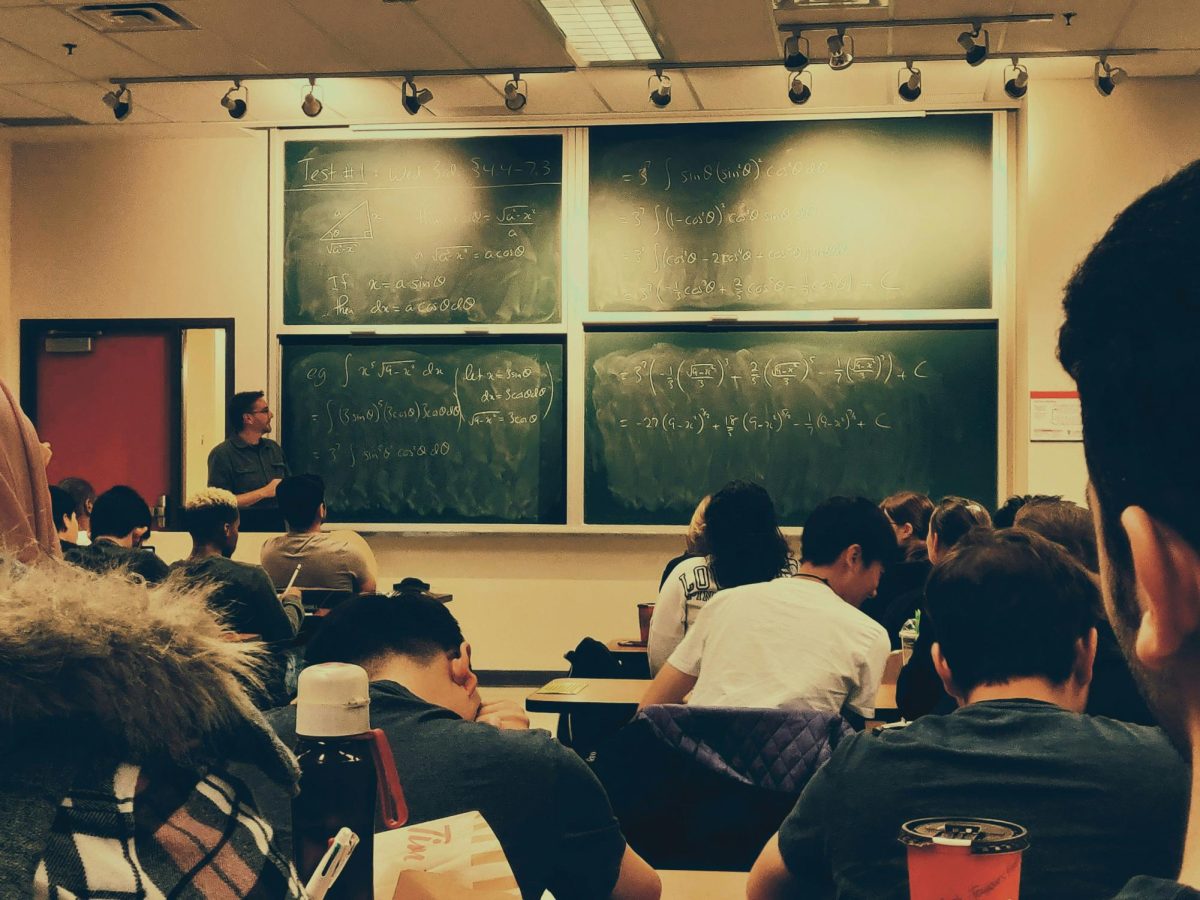

In addition to the disbelief, to the distaste I felt in my gut (and in my mouth thanks to the day-old coffee I was drinking), was my genuine concern about having a person with no experience managing a trillion-dollar loan program.

DeVos decided to remove the Obama administration’s cap on student loans on April 11, effectively rescinding protections from increased interest rates, a mistake that may have substantial ramifications.

While the loan cap didn’t stop 8.7 million people from defaulting on their debt, paving the way for companies to profit off the inaccessibility of higher education is morally wrong.

Sure, we could debate the government’s role in higher education, but allowing the predatory nature of business to directly affect access to college can also be considered of questionable intent.

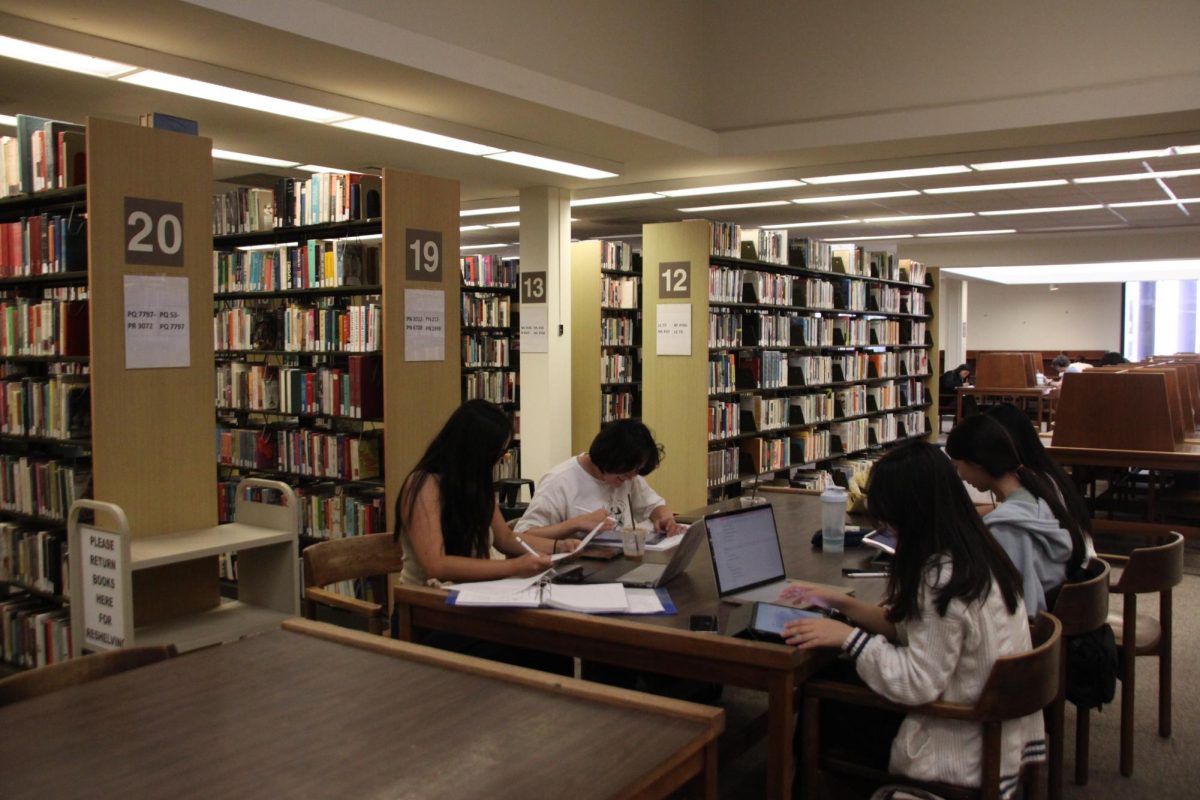

With students $1.31 trillion already in debt nationwide, higher interest rates don’t seem to have the students’ best interests at heart. They could potentially be a turn off for students who can’t afford to pay their tuition without financial aid.

If interest rates skyrocket enough, it is not inconceivable that there could be a decline in students receiving their bachelor’s degree. An average price of $25,000 for a year of college is simply too high.

There aren’t any clear solutions for this problem, unfortunately. It seems that, at least for the meantime, we are stuck with DeVos, and the price of higher education will continue to rise. I fear there may not be as many opportunities for students to receive an education, which could have a crippling affect on their future.

I’d urge our readers to contact DeVos directly at [email protected] to voice their concerns on this issue.