From DVC to Nasdaq: How Investing in People Took This Viking Alum All the Way to Wall Street

“Analyzing Stock Market” by ota_photos is licensed under CC BY-SA 2.0

March 15, 2021

With the recent deluge of new, every-day investors empowered by easily accessible, commission-free stock trading, pursuing a career in finance appears more enticing than ever. And if the recent GameStop phenomenon has shown us anything, it’s that savvy, young investors are harnessing the power of free information to educate themselves in this rapidly growing industry.

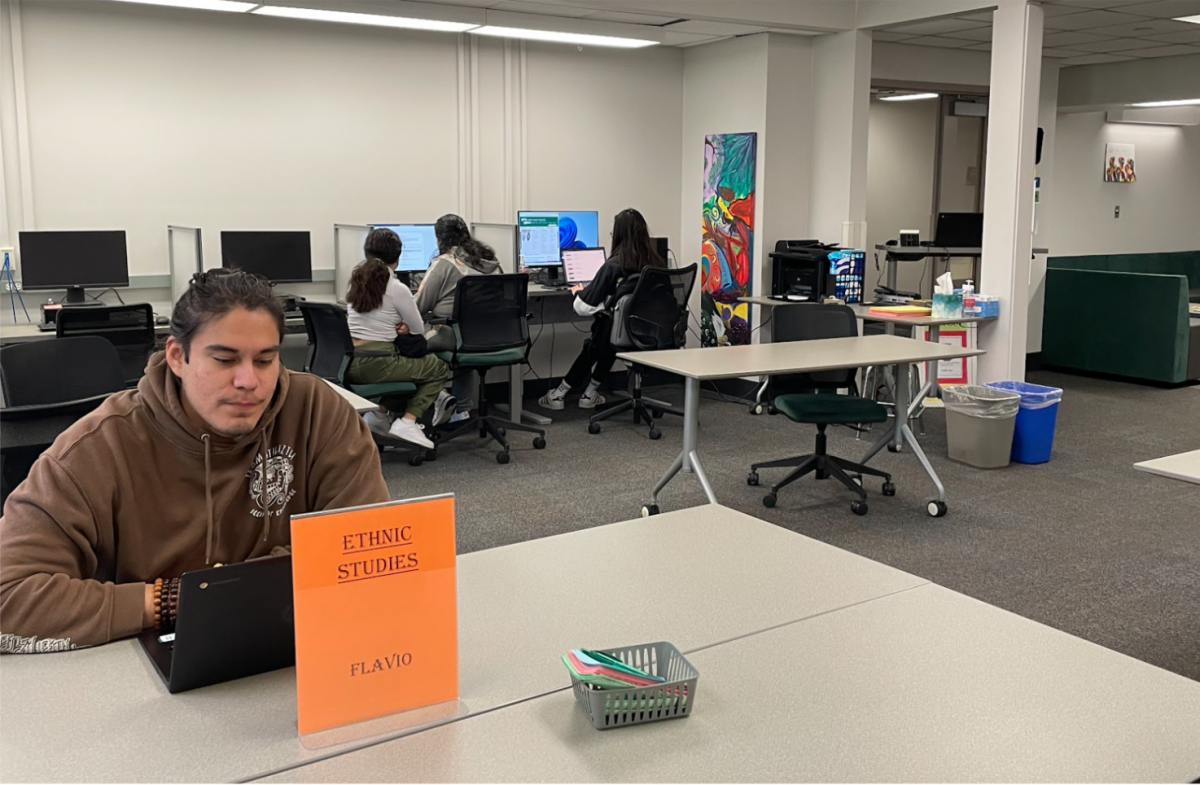

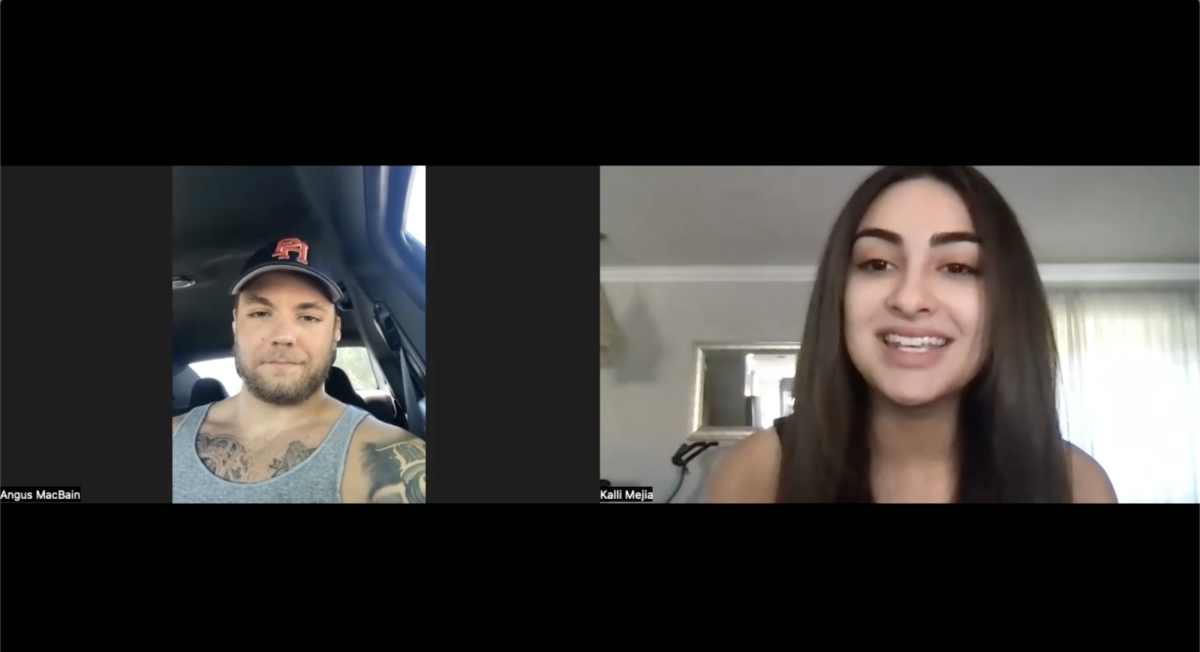

On March 2, Dan Angius, the managing director at Nasdaq, spoke with Diablo Valley College students through a virtual presentation hosted by Catherine Franco from DVC Workforce Development. Nasdaq is a financial services and technology company where Angius is responsible for advising and maintaining relationships with leaders and participants in the finance industry. He shared his insights with a noticeably eager and engaged audience—so much so that parts of the talk were cut short in favor of an extended Q&A.

He spoke about his college years which began at DVC and continued at the University of Southern California and Vanderbilt University. He also described his experience working at Goldman Sachs and his role at Nasdaq.

Angius’s candor invited thoughtful questions from the online audience, and I was fortunate to get a few of mine answered. When I asked for his best piece of advice for DVC students who want to enter the world of finance, he responded with two simple words: “Live it.”

“If you want a role in finance, understand the organism. Interact with it,” he said. “And you don’t even need money to do it. For example, choose your Robinhood app. Choose a portfolio of stocks. Choose one based on your own thesis, choose one based on other variables that might take in the viewpoints of others and just watch how they interact on a daily basis.”

There is value in Robinhood and similar investing apps beyond the dauntingly irrevocable act of investing real-life money. By merely exploring within these apps, hopeful investors will familiarize themselves with a new world of numbers and seemingly endless initialisms. They can build watchlists and track stock price movements to see how they might have fared had they entered the market. With enough time and diligence, much can be gleaned from simple observation.

The market for a career in investment banking is hyper-competitive and jockeying for a job at Goldman Sachs even more so. Intrigued, I asked about his path to working at one of the world’s largest investment banks.

“I started making phone calls,” he said, and “anyone that had any relationship with Goldman Sachs, at any level, I wanted to talk to. I think in a given semester leading up to when I was selected, I had over 100 phone calls [that] lasted about a half hour each.”

Angius recalled having 40 interviews in multiple cities, and described the recruiting process as “ridiculous.” He knew there would always be someone with better grades, so in an effort to differentiate himself from hundreds of other applicants, he sought to establish and maintain personal connections with people in the company.

That maintenance, he emphasized, is key. “If I’m going to stake on any type of thing that’s going to make me different, it’s going to be that. So let me just pick up the phone and just start calling people,” he said.

Perhaps initially profound and yet surprisingly apparent in retrospect, Angius describes a simple truth of social behavior: “People want to help you.”

“When you go to someone and say, ‘Can I have 15 minutes of your time to learn about the cool thing you’re doing at x, y, z company,’ … those people will be, more often than not, happy to help,” he said, “ and without any expectation of reciprocation.”

If there was anything DVC students could distill from his presentation, it was the importance of just talking. Interacting. Angius showed how forming sincere relationships helped secure his dream job in finance, and in the process, he revealed an even broader truth: that a persistent cultivation of human connection unlocks possibilities in life otherwise inaccessible or hidden from view.

Kelly • Apr 1, 2021 at 8:28 pm

This article is interesting. Since Dan Angius provided a virtual presentation, I am assuming that there is a recording of his presentation. Can you provide that video, maybe as an attachment to your article? Thank you!