At the governing board meeting on April 25, 2012, EMR Research presented their survey results, which recommended that a parcel tax measure be placed on the November 2012 ballot in order to increase operational revenues within the district.

“If structured properly…I think it can help us with the structural deficit, save jobs and help students,” Peter Garcia, DVC president, said.

EMC Research was contracted by the district to test whether or not it would be a viable option to add a parcel tax or a bond to the November ballot to alleviate the financial burdens that have been placed on community colleges by the state.

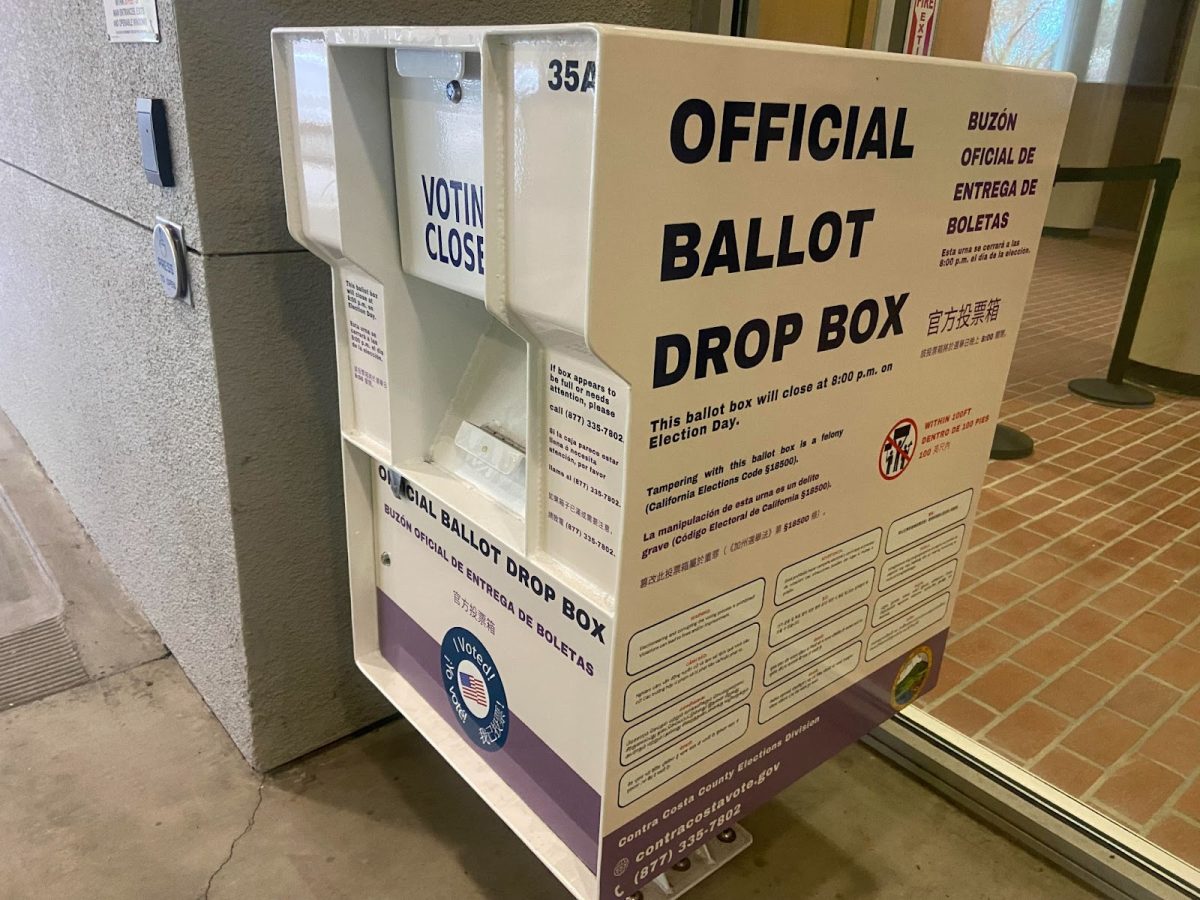

They surveyed 1,201 of what they called “likely voters” across Diablo Valley College, Los Medanos College, and Contra Costa College service areas. Using a split-sample method, half of the interviewees were asked about a bond measure and the other were asked about a parcel tax. The parcel tax had the support of 72 percent of likely voters polled.

“There’s a strong perceived need for the colleges and the parcel tax is a significant small dollar amount that people are willing to spend,” Alex Evans, Principal at EMC Research said.

The parcel tax would be $11 per parcel and would sunset after six years, unless a renewal was approved by future voters to continue the program.

EMC Research came up with the tax amount by considering the budget deficit. “If that number is around $9 million, what would be an appropriate tax to put on that…that was the $11,” Evans said. “We were very conservative in that amount.”

The parcel tax would bring an estimated $3.5 million to $4 million a year for six years to be spent on operational costs within the district.

“Its certainly not going to take care of all the problems, but its [going to help us add sections],” Sheila A. Grilli, vice president of the Board of Governors, said.

Evans agreed, but urged the importance of getting a parcel tax started. “We know that doesn’t completely meet your need, but [you] will have better chances with voters later,” when they will be called upon to renew the sunset on the tax.

A strong 81 percent of likely voters surveyed district-wide were in support and said “local community colleges need money” and EMC Research suggests the parcel tax, not a bond, is the way to get it.

“It does appear the parcel tax is the more critical need,” Evans said.

A bond measure for $255 million in facilities was tested among the interviewees and received 65 percent of likely voter support.

Bond funds could only fund certain projects such as a new student learning center or new medical career facilities, but could not be spent on the operational costs needed to run them.

The study found that the district is not in need of more bond money. “Much of the money from those earlier bonds has not yet been spent,” the survey said.

It was estimated that the district construction funds “still have $80 million now for one to two years,” Dr. Helen Benjamin, Chancellor of the Contra Costa Community College District, said.

The potential voters surveyed made it clear that their priorities were aligned with student services. The survey listed the factors most important to those surveyed: to prepare students for jobs and careers, provide core academics such as English, math and science, ensure the availability of classes and prepare students to transfer into four year universities.

The likely voters were in favor of paying a parcel tax to receive these services, even in the current economic climate.

“The parcel tax vote stays high even after [voters are] reminded of the economy,” the survey said.

A subcommittee was established during the Board of Governor’s meeting to move forward with a tax initiative for the November ballot. President of the Board of Governors Tomi Van de Brooke and secretary of the Board of Governors John E. Marques volunteered to serve on the subcommittee and invited other board members to participate in their discussions.

“Hopefully revenues in the state will pick up so that $3-4 million will be enough,” Van de Brooke said.

“If you can get this program started…you have the opportunity to prudently increase [the $11 per parcel],” Evans said. “If $11 isn’t enough [for you, you’ll be] stepping away from a great opportunity.”