How Inflation is Making Life Harder for College Students

With interest rates and consumer prices sharply on the rise in the United States, college students are feeling a direct impact from inflation.

Take Bella Montes, a freshman at Diablo Valley College. As many young adult students are out enjoying their Friday night with their friends this week, Montes will be heading straight to work from school. This has been her reality for the past few months – having to pick up extra shifts to pay for college requirements and the rising price of gas.

“This is my first year at DVC and I did not expect to be spending so much on school,” Montes said. “I mean, I knew I needed to worry about textbooks, but I had no idea how expensive it would be to get to and from school. I spend $100 a week on gas just for school commuting.”

College students especially have been struggling due to the economic instability the country is experiencing in recent months.

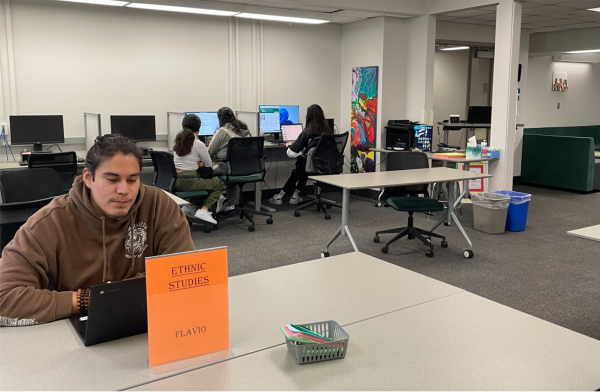

Agustin Perez has been a full-time student at DVC for two years, working toward his degree in psychology. He also works full-time. Like other students, his academic success depends on how much time he can commit to his studies.

But these days, given the growing financial pressures, he finds he has less energy to devote to school.

“I have not been able to put as much time as I would like towards my classes because I am working longer shifts to pay for things like groceries, gas and wifi for my online [courses],” Perez said.

“It is really affecting my ability to focus on school, but I am determined to get it done.”

According to the U.S. Bureau of Statistics, the Consumer Price Index for the month of July stood at 8.5 percent – a significant increase from 5.4 percent recorded during the same month last year. The Consumer Price Index is a measure of the average change in prices over a period of time.

Amid the crisis facing young people, DVC’s financial aid and counseling offices have offered some hope – and in some instances, financial coaching – for currently enrolled and future students.

According to Emily Stone, dean of counseling and student success programs, the school’s financial aid office has teamed up with Sparkpoint to help students with tasks such as budgeting, establishing credit, and enrollment in programs like Medi-Cal, among other services. Sparkpoint was developed in 2009 and is a free, non-profit service for Bay Area members.

An emergency one-time $1,000 grant provided by DVC offers financial support to students who are struggling with their everyday expenses. Every student is encouraged to review the information and apply.

Additionally, the DVC food pantry provides free groceries to enrolled college students and is open Wednesdays and Thursdays from 10:30 a.m. to 4:30 p.m. The online, confidential application for the food pantry takes a few minutes and is an easy step towards providing some relief for students facing food scarcity.

At the same time, if a student is struggling with technology needs, DVC provides a Student Technology Loaner-Program, which includes computers, wifi hotspots, headphones and webcams.

Stone advised people in need of help to “reach out, because all students have access to financial support and guidance.”